OPEC+ is considering delaying its planned production increases amid concerns over market stability. The alliance is weighing a postponement of its 120,000 barrel-per-day supply hike set for April, marking the fourth such delay since 2022. Meanwhile, a Ukrainian drone attack on a Russian pumping station has disrupted Kazakhstan’s crude exports, further tightening supply. OPEC+ aims to keep prices within the $70-$74 range, prioritizing price stability over market share, while traders also monitor geopolitical developments, including U.S.-Russia talks on Ukraine.

Goldman Sachs stated that a potential Ukraine ceasefire and easing of sanctions on Russia are unlikely to significantly increase Russia’s oil exports, as its production is constrained by its OPEC+ target of 9 million barrels per day. The bank expects OPEC+ to delay its planned production increase until July due to higher compliance with output targets and ongoing U.S. policy uncertainty. Despite previous plans to raise output in April, OPEC+ extended its production cuts through Q1 2025 in response to weak demand and rising non-OPEC supply. Goldman Sachs maintains its forecast that Brent crude could reach $79 per barrel later this month.

Kazakhstan achieved record-high oil production of 2.12 million bpd on February 19, despite a significant reduction in capacity on its main export route, the Caspian Pipeline Consortium (CPC), due to a Ukrainian drone attack. The Tengiz oilfield, operated by Chevron-led Tengizchevroil, played a key role in this increase, with output rising to over 920,000 bpd. However, with CPC handling over 80% of Kazakhstan’s exports, the 30-40% pipeline flow reduction—equating to 500,000-680,000 bpd—poses challenges for sustaining high exports. Russian President Vladimir Putin warned that the damage would impact global energy markets and be difficult to repair due to reliance on Western equipment.

Chinese refiners are increasing purchases of Brazilian and West African crude due to higher Middle Eastern oil prices and trade disruptions caused by U.S. sanctions and tariffs. Imports from Brazil are expected to reach 800,000 barrels per day in February, with further increases anticipated in March and April. The shift has driven up premiums for these crude grades by about 50% since January, as refiners seek alternatives to expensive Gulf oil. Additionally, new refineries like Shandong Yulong Petrochemical are securing large shipments from Angola and Nigeria, while state trader Unipec has bought over 20 million barrels of Brazilian crude for April delivery.

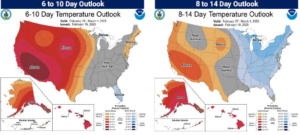

Frigid temperatures across the U.S. Northeast have driven a surge in heating oil demand, pushing distillate fuel consumption 9% above last year’s levels and dropping inventories to their lowest seasonal level since 2014. Despite this temporary spike, long-term U.S. distillate demand remains on a downward trend due to declining industrial activity and the rise of renewable diesel, which grew to 240,000 barrels per day in 2024. U.S. diesel exports also surged by nearly 20% in January, further tightening domestic supply and boosting refining margins on the East Coast. However, with manufacturing contracting and the trucking industry slowing, distillate demand is expected to weaken in the coming months unless economic conditions shift significantly.

This weeks DOE report is below. Please call your Energy Account Manager with any needs you may have.

Propane

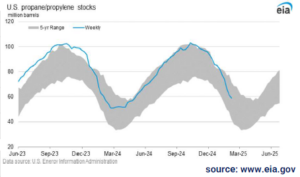

The EIA reported a draw of 3.59 million bbls on US inventories to 55.269 million overall. The draw was slightly above the expectations calling for a draw of 3.26 million bbls. The five-year week 7 average had been a draw of 3.435 million bbls. Region specific the Midwest posted a weekly draw of 1.35 million and the Gulf region posted a draw of 2.37 million bbls.

Production at 2.665 mbpd was up 2.1% over last week, while exports were up 20% at 1.988 mbpd – 75% of total production.

Please call your Energy Account Manager with any needs you may have.

NuWay-K&H Cooperative Customer Portal

Through our portal, you can check billing, make payments, request a quote, check previous years product usage, see invoices and statements, and much more. We also offer digital contracting through the portal where you can sign and pay your energy contracts through our mobile app or desktop site. Click here to log in!