It has been a wild week for refined fuel to say the least, the exception being Monday, which was slightly down. Every day since has seen minimal to large gains in crude and in products. Today that trend continues, this morning was fairly quiet, but at the time of this writing distillate is up $.05 and gas is up about a penny.

Most of the recent factors are global news events, we are however experiencing some Midwest issues, which I will explain shortly. The continuing stalemate for a ceasefire between Israel and Hamas is having the biggest effect currently. Israel had made an initial ceasefire proposal, Hamas countered with an offer that Israel rejected. Diplomatic efforts continue to try to reach a resolution, but progress at this time is limited.

Wider Middle East tensions have kept the market on edge since October, with Houthi rebels continuing attacks in the Red Sea. This is driving up freight costs as shipping companies are diverting their fleets to longer routes, which adds more time, and expense, and puts a drag on the supply chain. There are also reports this week of two Ukrainian drones striking the largest oil refinery in southern Russia over the weekend, the latest in a series on long-range attacks on Russian oil facilities.

Here at home, supply from southern refineries due to the January 2024 freeze have been slow to recover. It is also possible that refiners will take this time to start seasonal maintenance, this of course is necessary, but does reduce supply in the short term. And as mentioned above, on Thursday Feb 1st, a power outage was reported at BP’s 440,000 bbls/d Whiting, IN refinery, forcing the shutdown of the largest refinery in the Midwest. The shutdown triggered Chicago diesel and gas prices to skyrocket and triggered a jump in basis pricing. The outage continues and is also now affecting Group 3 gas and diesel basis, that were up 8 and 10 cents respectively yesterday. All of the events mentioned are causing price spikes, hopes are that one or more of these situations could change and tame the market, but for now it seems the bulls are on the move.

Propane

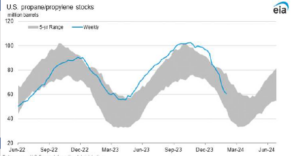

Overall U.S. LP inventories are still forecasted by end of winter to be on the higher side. We were well above the 5 yr average at the beginning of the heating season, but a period of cold snaps and inventory corrections have substantially dropped U.S. propane stocks. We are still within the 5 yr average though (see 1st chart below).

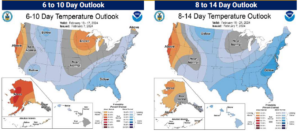

Temps are remaining above normal to near normal for the short term (see 2nd chart below). While there is still the possibility for some cold temps (we aren’t out of the woods yet) we are winding down and could end the season with a decent inventory level, which will help towards pricing for the next season. Come on Spring!

We are offering contracting for the 2024-2025 heating and drying season, if you are interested in a quote, please reach out to your Energy Account Manager.

NuWay-K&H Cooperative Customer Portal

Through our portal, you can check billing, make payments, request a quote, check previous years product usage, see invoices and statements, and much more. We also offer digital contracting through the portal where you can sign and pay your energy contracts through our mobile app or desktop site. Click here to log in!