The U.S. economy showed stronger-than-expected growth in the second quarter, with GDP rising at a 3.0% annualized rate, outpacing the 2.4% forecast, after a contraction earlier this year. However, economists caution the number may be distorted by trade activity and inventory fluctuations. Inflation came in cooler than expected at 2.1%, leading to tempered expectations for growth in the second half of 2025.

Meanwhile, oil markets remain on edge amid rising geopolitical tensions. President Trump intensified pressure on Russia and its oil customers, particularly China, by shortening the deadline for progress on a Ukraine peace deal. This could lead to 100% tariffs—or higher—on buyers of sanctioned Russian oil, potentially disrupting global supply chains. China has signaled it will resist such moves to protect its energy sovereignty, while India is expected to comply.

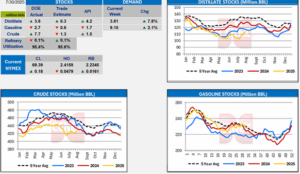

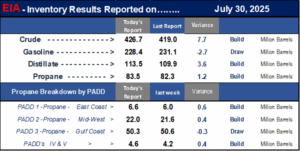

The American Petroleum Institute reported a surprise build in U.S. crude and distillate inventories, countered by a gasoline stock draw. These figures precede official data from the EIA. This week DOE’s report is below for your viewing.

In other developments, Trump and EU leaders announced a major trade agreement involving a 15% U.S. tariff on EU goods and a $600 billion EU investment in American energy and military sectors. This follows a similar pact with Japan.

The Federal Reserve is set to release its policy statement tomorrow amid mixed signals from the economy and political pressure to cut interest rates, though expectations are for no change. Trucking activity—a key economic indicator—remained sluggish, with the ATA noting a second straight monthly decline.

OPEC+ ministers are meeting today to monitor production targets, with expectations of additional output increases in September despite uneven compliance by some members.

Finally, the U.S. and China concluded another round of trade talks, with a likely 90-day extension of their tariff truce, as negotiations grow increasingly complex due to China’s dominance in key global markets like rare earths.

If you have any questions or would like current pricing, please contact your Energy Account Manager.

Propane

Propane/propylene inventories increased by 1.1 million barrels from last week and are 9% above the five-year average for this time of year. This week exports were down slightly. Still exporting 1,629 million barrels this week. We will have to continue to monitor the builds going forward and how high we can push inventories as we work the rest of the way through the summer.

This week DOE’s report is below for your viewing.

If you have any questions or would like current pricing, please contact your Energy Account Manager.

NuWay-K&H Cooperative Customer Portal

Through our portal, you can check billing, make payments, request a quote, check previous years product usage, see invoices and statements, and much more. We also offer digital contracting through the portal where you can sign and pay your energy contracts through our mobile app or desktop site. Click here to log in!