OPEC+ Output Strategy

- Modest Increase: OPEC+ will raise production by 137,000 barrels per day starting in November.

- Purpose: A cautious move to maintain market stability and avoid oversupply.

- Market Reaction: Traders see it as slightly bullish, reflecting ongoing geopolitical risks and uncertainty about winter demand.

- Spare Capacity Shrinks: Continued output increases since March (totaling 2.7 million bpd) are reducing OPEC+’s spare capacity, limiting flexibility for future disruptions.

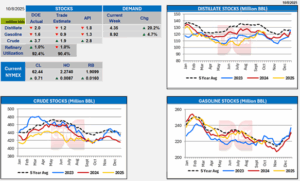

U.S. Oil & Gas Trends

- Rig Count Stable: 549 active rigs (422 oil, 118 gas), down 6% from last year.

- Focus: Companies remain cautious, prioritizing financial discipline over expansion.

- Record Output Forecast: U.S. crude production projected to hit 13.53 million bpd in 2025, a new high.

- Price Pressure: Despite strong output, growing inventories may weigh on prices; WTI forecast to average $65/barrel in 2025 (15% lower than 2024).

Russian Refining Disruptions

- Drone Attacks: Ukrainian strikes have disabled ~40% of Russia’s refining capacity.

- Impact: Domestic fuel shortages and restricted diesel/gasoline exports, tightening global supply.

- Refined Product Prices Up: European and Asian refiners benefit from higher margins; global gasoline and diesel prices rise.

India–Russia Oil Trade

- Continued Imports: India keeps buying discounted Russian crude, despite U.S. pressure.

- Narrowing Discounts: Urals crude discount has shrunk from $20–25 to $2–2.50 per barrel, signaling a tightening market.

- Alternative Payment: India is now settling some Russian oil trades in Chinese yuan, reducing reliance on the U.S. dollar and complicating sanctions enforcement.

- Market Drivers Lacking Amid Data Delays

- U.S. Government Shutdown: Delayed release of key economic indicators like jobs, inflation, and spending.

- Market Impact: With fewer data points, traders look to stock markets as a gauge for economic health.

- Consumer Spending Supported: Strong equities and household wealth continue to drive consumption, even as the job market slows.

Clean Energy Funding Cuts Under Review

- DOE Action: U.S. government may cancel over $12 billion in clean energy funding, affecting EV and carbon capture projects.

- Why: A move to scale back climate-related spending, focusing on higher-return initiatives.

- Already Cut: $7.56 billion in low-performing projects dropped; more under review, including grants to major firms like GM, Stellantis, and Occidental.

Overall Outlook

- Energy markets remain tight due to limited spare capacity, geopolitical tensions, and supply disruptions.

- U.S. production growth continues, but price gains are capped by inventory builds.

- Global trade dynamics are shifting, with growing use of non-dollar payments and evolving alliances.

- Policy uncertainty—especially around climate and energy funding—adds to market unpredictability.

- If you have any questions or would like current pricing, please contact your Energy Account Manager.

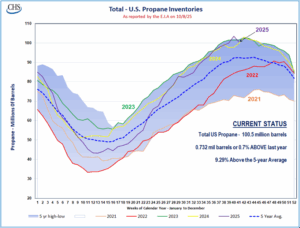

Propane

Due to reduced Russian pipeline gas, Europe will need 160 additional LNG shipments this winter with nearly half of the EU’s supply expected to come from LNG, supporting U.S. natural gas prices. Meanwhile, U.S. propane/propylene inventories fell by 2.9 million barrels but remain 9% above the five-year average.

If you have any questions or would like current pricing, please contact your Energy Account Manager.

NuWay-K&H Cooperative Customer Portal

Through our portal, you can check billing, make payments, request a quote, check previous years product usage, see invoices and statements, and much more. We also offer digital contracting through the portal where you can sign and pay your energy contracts through our mobile app or desktop site. Click here to log in!