Geopolitical Developments

Middle East Tensions Intensify

Israel has expanded its military operations with a targeted airstrike in Doha, Qatar, aimed at Hamas leadership. The strike, which killed five Hamas members, has drawn strong criticism from both Qatar and the U.S., with concerns it could derail ongoing ceasefire negotiations. Qatar, a key mediator in Gaza peace talks, condemned the action as a breach of international law.

Separately, Israel has issued a final warning to Gaza City residents to evacuate, threatening a broader offensive unless Hamas releases remaining hostages. Hamas is currently reviewing a new U.S.-backed ceasefire proposal, though internal divisions persist.

Energy & Commodities

U.S. Oil Sector Faces Headwinds

The U.S. oil industry is seeing slower production growth amid lower prices and ongoing consolidation. This has led to workforce reductions, $2 billion in spending cuts, and a 69-rig decline year-to-date. Major producers are scaling back operations, with WTI crude prices hovering around $62—below the $70–$75 threshold needed to sustain growth. Analysts expect flat or declining U.S. output in 2025.

OPEC+ to Raise Production Slightly

OPEC+ announced a modest output increase of 137,000 barrels per day starting in October, aiming to regain market share despite weaker demand forecasts. The move signals strategic positioning by key players like Saudi Arabia and the UAE, even as global prices remain under pressure.

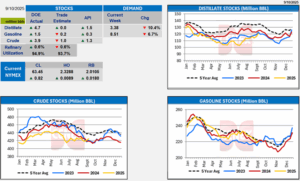

U.S. Inventory Trends Diverge

Analyst forecasts expected crude and gasoline inventory draws last week, while distillate stocks were projected to rise slightly. However, API data showed unexpected builds across all three categories, highlighting ongoing market volatility.

U.S. Rig Count Trends

The U.S. rig count declined to 536 as of August 29, marking an 8% year-over-year decrease. While oil-directed rigs rose slightly, they remain 15% below last year. The Permian Basin held steady, but activity remains subdued compared to 2024.

Global Trade & Sanctions

EU Eyes Accelerated Russian Energy Phase-Out

The EU is debating a faster phase-out of Russian fossil fuels as part of its 19th sanctions package. A full ban on oil and gas imports could be moved up from 2028. However, opposition from energy-dependent countries like Hungary and Slovakia may delay action. Analysts warn that without cooperation from China, India, and the UAE, the sanctions’ overall impact may be limited.

New Sanctions Could Disrupt Russian Oil Flows

The U.S. is considering secondary sanctions on Russian oil buyers, including India and China. While India defends its imports, new tariffs and pressure from the U.S. may shift global crude trade patterns. Coordination among non-Western powers could reduce the effectiveness of further Western sanctions.

Tariffs Impact Global Petrochemicals Trade

U.S. tariffs are pressuring the petrochemicals sector, prompting Chinese exporters to redirect supply to Asia and undercut regional producers. Industry leaders warn that trade volumes may fall another 15%, complicating investment planning amid growing protectionism. Indian demand remains one of the few stable growth areas.

If you have any questions or would like current pricing, please contact your Energy Account Manager.

Propane

Propane inventories increased by 1.5 million barrels this week. Current propane inventory levels are 12% higher than last year. As we come into the end of the build season propane inventories look healthy.

This week DOE’s report is below for your viewing.

If you have any questions or would like current pricing, please contact your Energy Account Manager.

NuWay-K&H Cooperative Customer Portal

Through our portal, you can check billing, make payments, request a quote, check previous years product usage, see invoices and statements, and much more. We also offer digital contracting through the portal where you can sign and pay your energy contracts through our mobile app or desktop site. Click here to log in!