OPEC+ shocked markets by announcing a 411,000-bpd output increase starting in May, tripling the pace of planned hikes despite plummeting oil prices and fears of a global economic slowdown. The group claimed the decision was based on a “positive market outlook,” though the timing coincided with a deepening selloff triggered by U.S. tariffs and China’s retaliation. The move added bearish pressure to an already declining market, with WTI crude sliding sharply into levels not seen since the pandemic’s worst days. Analysts suggest the hike is less about demand optimism and more about internal struggles to enforce production discipline among members like Kazakhstan.

The deepening U.S. vs China trade war is fueling fears of a global economic slowdown, which in turn is pressuring oil prices lower. With both nations imposing steep tariffs on each other’s goods, analysts worry the standoff could dampen industrial activity and transportation demand, two key pillars of oil consumption. While energy products like crude oil weren’t directly targeted in this round, the broader implications for global trade and GDP growth have added to bearish sentiment in the oil market. Traders are increasingly cautious, with demand side concerns outweighing recent supply-side developments.

Global markets continued their sharp selloff on Friday as fears of a looming recession escalated following President Trump’s sweeping new tariffs, the steepest trade barriers seen in over a century. U.S. stocks lost $2.4 trillion in value in a single day, their worst drop since March 2020, while Asian markets remained under pressure amid thin holiday trade. Safe-haven assets like gold and the Swiss franc surged, and the U.S. dollar slid to a six-month low as traders priced in nearly a full percentage point of Federal Reserve rate cuts by year-end. Market sentiment remains fragile, with investors awaiting Fed Chair Jerome Powell’s comments for signs of a policy pivot amid rising stagflation risks.

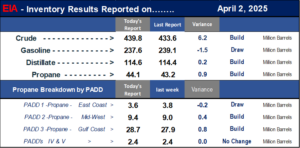

This week’s DOE report released on 4-2-25 is available for your viewing below

Please contact your Energy Account Manager with any questions or needs that you may have.

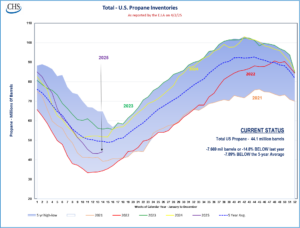

Propane

Propane hubs have opened sharply lower again this morning with Conway off over 8% from yesterday’s close. The ongoing fall in the crude markets is continuing to be a weight on propane hubs and will likely continue to be a key driver for any direction for propane in the midst of the volatility.

China’s Finance Ministry on Friday said it will impose a 34% tariff on all goods imported from the U.S. starting on April 10. U.S Major markets are down 2-3% this morning. Additionally, the major European Stoxx 600 index is down 4%.

This week’s DOE report released on 4-2-25 is available for your viewing below along with the current propane inventories graph.

Please contact your Energy Account Manager with any questions or needs that you may have.

NuWay-K&H Cooperative Customer Portal

Through our portal, you can check billing, make payments, request a quote, check previous years product usage, see invoices and statements, and much more. We also offer digital contracting through the portal where you can sign and pay your energy contracts through our mobile app or desktop site. Click here to log in!