Supply Disruptions & Geopolitics

Caspian Pipeline Consortium (CPC): Ukrainian drone strikes over the weekend caused major damage to the CPC Black Sea terminal, which handles over 1% of global oil supply and the majority of Kazakhstan’s exports. Loadings were briefly halted, and although one mooring (SPM-1) has resumed, another remains heavily damaged and a third under repair until early 2026. Flows remain well below normal, tightening regional supply.

Russia–Ukraine & U.S.–Russia diplomacy:High-level talks between U.S. envoys and President Putin extended five hours, with both sides calling discussions “constructive,” though no breakthrough was reached. Negotiations continue amid Russia’s threat to take action against tankers supporting Ukraine—another source of geopolitical risk for oil flows.

Venezuela: Market uncertainty increased after President Trump suggested the U.S. may consider closing Venezuelan airspace, with no details provided. The lack of clarity raises risk premiums tied to Venezuelan supply and regional stability.

OPEC+ Policy Signals

Eight OPEC+ members reaffirmed a pause on output hikes for Q1 2026, signaling caution as the group confronts an emerging supply glut after adding ~2.9 mb/d since April 2025.

Roughly 3.24 mb/d in existing cuts remain intact.

OPEC will also conduct a capacity assessment (Jan–Sep 2026) to establish new 2027 production baselines, adding potential uncertainty to medium-term output trajectories.

U.S. Production & Market Fundamentals

U.S. crude output hit a new record in September at 13.84 mb/d, up 44 kb/d month-on-month.

Key growth drivers:

– New Mexico: Reached a record 2.351 mb/d.

– Federal offshore Gulf: Highest since Feb 2020 at 1.983 mb/d, a region increasingly central to future U.S. growth.

Rising U.S. production contributes to oversupply concerns, with crude prices roughly 14% below year-earlier levels.

Downstream & Consumer Trends

U.S. gasoline prices fell below $3/gal—the first time since 2021—helping offset consumer sentiment that dropped to the lowest level since April.

Softer fuel prices reflect ample supply and easing refiners’ margins.

Overall Market View

The energy market is balancing record U.S. output and signs of OPEC+ caution against escalating geopolitical risks in the Black Sea and Latin America. CPC disruptions introduce immediate tightening in regional crude flows, while ongoing diplomatic activity around the Russia–Ukraine conflict may swing risk sentiment. Near-term volatility is expected as the market digests supply losses from CPC, ambiguous signals from Venezuela, and OPEC+’s slower production-normalization path.

If you have any questions or would like current pricing, please contact your Energy Account Manager.

Propane

Propane/Propylene:

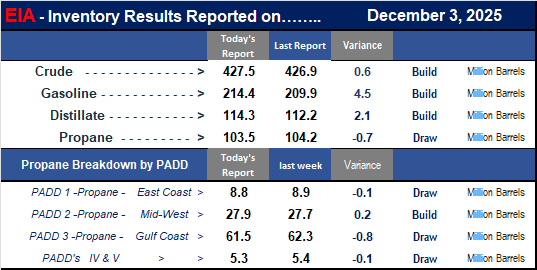

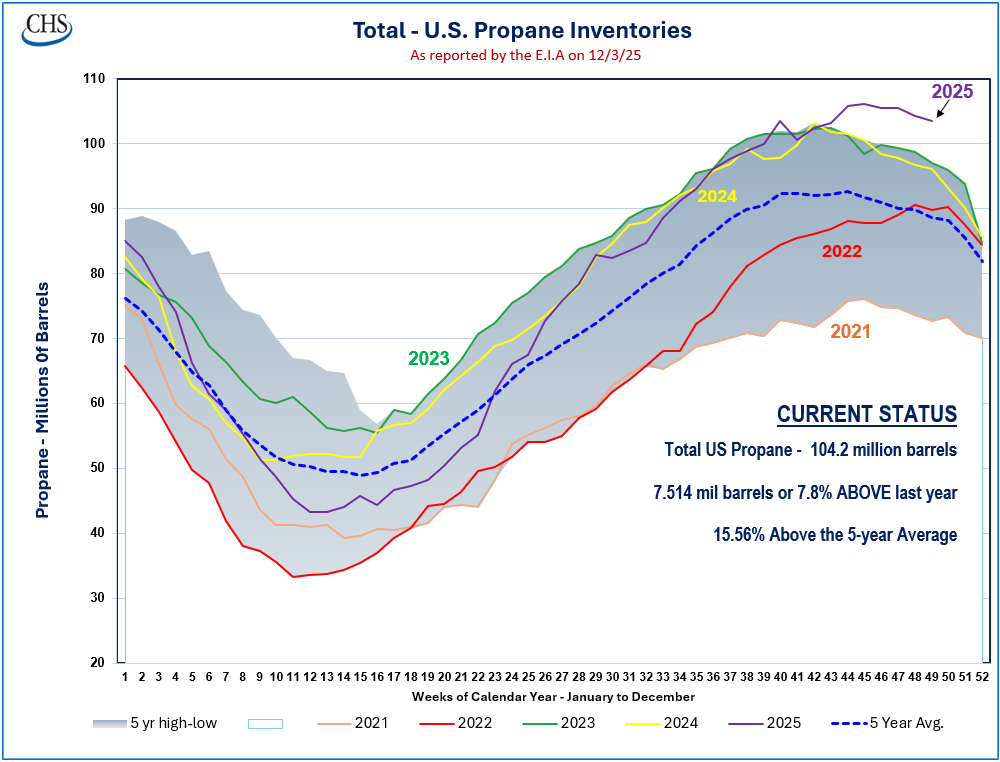

U.S. propane/propylene stocks fell 0.7 million bbl on the week but remain ~15% above the five-year average, maintaining a comfortable supply cushion.

Inventories now stand 7.5 million bbl above year-ago levels, up 7.8% YoY.

Regional Inventory Moves:

Gulf Coast (PADD 3): –0.8 million bbl

Midwest (PADD 2): +0.2 million bbl

East Coast (PADD 1): –0.1 million bbl

PADD 4/5 (Rocky Mountain & West Coast): –0.1 million bbl

→ Overall regional draw signals stronger export pulls and steady domestic demand.

Exports & Market Balance:

Propane exports jumped 339,000 bpd to 2.019 million bpd, a key driver of the weekly draw despite expectations for a larger decline.

Market consensus expected a 1.47 million bbl draw; the reported 0.7 million bbl draw came in tighter but still directionally aligned.

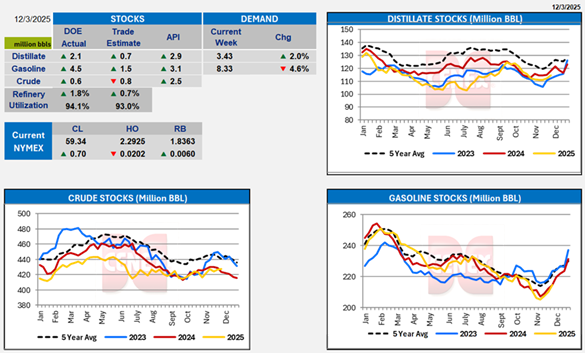

Total Commercial Petroleum:

Total U.S. commercial petroleum inventories rose 5.2 million bbl, reinforcing broader supply length across the market.

Summary:

The propane market remains well-supplied despite a moderate weekly draw driven by stronger exports. Stocks remain high versus both seasonal norms and last year, limiting upward price pressure even as regional draws appear along the Gulf Coast. Overall petroleum inventories increased, underscoring a generally well-balanced to loose market environment.

If you have any questions or would like current pricing, please contact your Energy Account Manager.

NuWay-K&H Cooperative Customer Portal

Through our portal, you can check billing, make payments, request a quote, check previous years product usage, see invoices and statements, and much more. We also offer digital contracting through the portal where you can sign and pay your energy contracts through our mobile app or desktop site. Click here to log in!