Venezuela: Oil Flow Reshuffling

Global trading houses Vitol and Trafigura have quickly positioned themselves as the first major players moving Venezuelan crude under U.S. oversight, outpacing U.S. energy majors who remain wary of legal and credit risks.

The U.S. and Caracas are finalizing a $2B deal to sell up to 50 million barrels of crude.

The U.S. is controlling revenue channels via the interim government while Venezuela works to restart exports after a month‑long blockade.

Separately, China‑bound supertankers reversed course due to sanctions pressure, indicating continued delays in Venezuelan crude shipments to Asia.

As the U.S. diverts more Venezuelan crude, China’s February imports are set to fall sharply—from ~642,000 bpd in 2025 to roughly 166,000 bpd, affecting independent refiners (“teapots”) the most.

Exxon Mobil Tensions

Following Exxon Mobil CEO Darren Woods’ comments that Venezuela is “uninvestable” without major legal reform, President Trump said he may block Exxon from participating in future Venezuelan projects.

Exxon and ConocoPhillips—still owed $13B from past expropriations—signaled they will not return without strong legal guarantees.

The administration insists companies must negotiate through Washington, not Caracas.

Russia–Ukraine: Intensified Energy Strikes

Kyiv remains under severe energy stress after Russian strikes left 1,000+ buildings without heat in freezing conditions.

Emergency crews continue working to restore power and heating.

Russia has targeted Ukrainian grid infrastructure daily over the last week, with more damage expected to take several days to repair.

Black Sea Drone Attacks

Two oil tankers—including one chartered by Chevron—were struck by drones near a crucial Russian export terminal handling 80% of Kazakhstan’s oil exports.

Chevron reports the vessel stable and crew safe.

The incident adds pressure to an already strained regional supply picture.

Norway Offshore Licensing

Norway awarded 57 new offshore exploration licenses to 19 companies—its highest number ever in mature areas.

This supports Norway’s long‑term goal of smoothing future production declines.

Environmental groups and the Green Party protested expanded drilling.

Market Outlook

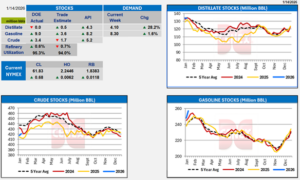

The oil market is being pulled in opposite directions by geopolitical risk and inventory strength:

Bullish Drivers

Drone attacks and heightened conflict risk in Russia/Ukraine and the Black Sea create potential supply disruptions.

Instability in Venezuela, Iran, and other OPEC+ countries is supporting a risk premium.

Winter weather is increasing near‑term demand for heating fuels.

Bearish Drivers

Large U.S. inventory builds may temper bullish sentiment if confirmed.

Increased Venezuelan supply to global markets, especially the U.S., could ease tightness in heavy crude markets.

China’s reduced buying of Venezuelan crude may shift barrels elsewhere, adding to global availability.

Overall

Expect continued volatility, with geopolitical events keeping a floor under prices while strong inventories and redirected Venezuelan flows limit sustained rallies. The market remains highly headline‑driven, and traders will be watching DOE inventory data and Black Sea developments closely.

If you have any questions or would like current pricing, please contact your Energy Account Manager.

Propane

Propane Inventory & Fundamentals

The EIA reported a 2.39 million‑barrel draw on U.S. propane inventories, bringing total stocks to 95.7 million barrels—almost exactly in line with expectations of a 2.2 million‑barrel draw but much smaller than the 5‑year average draw of 5 million barrels for this week.

Key weekly changes:

- Exports: Up 200,000 bpd to 2.076 million bpd

- Imports: Up 9,000 bpd

- Production: Up 65,000 bpd to 2.891 million bpd

- Domestic demand: Down 101,000 bpd

- Export share: Exports equaled 71.8% of weekly propane production

Regional Inventory Changes

- All major PADDs posted declines:

- PADD 3 (Gulf Coast): –600,000 bbl

- PADD 2 (Midwest): –1.1 million bbl

- PADD 1 (East Coast): –500,000 bbl

- PADD 4 & 5: –100,000 bbl

Propane Outlook

Despite a respectable weekly draw, propane inventories remain well above last yearand above seasonal norms. Strong exports are helping balance the market, but elevated total stocks and rising production continue to limit upward price pressure.

Expect range‑bound pricing with modest support from winter demand but capped by ample supply. Any additional increases in exports or a meaningful cold‑weather demand spike would be the primary bullish catalysts.

If you have any questions or would like current pricing, please contact your Energy Account Manager.

NuWay-K&H Cooperative Customer Portal

Through our portal, you can check billing, make payments, request a quote, check previous years product usage, see invoices and statements, and much more. We also offer digital contracting through the portal where you can sign and pay your energy contracts through our mobile app or desktop site. Click here to log in!