U.S. Energy Stocks Rise on Venezuela Developments

U.S. oil stocks climbed after President Trump said the U.S. would take control of Venezuela, raising expectations that American companies could gain access to the world’s largest oil reserves. Chevron, currently the only U.S. major operating in Venezuela, led gains, while refiners and oilfield services companies also rose on hopes of increased heavy crude supply and future infrastructure investment. Despite the equity rally, oil prices were mostly unchanged as global supply remains ample and U.S. sanctions on Venezuelan exports are still in place.

Venezuela Oil Outlook: Long-Term Opportunity, Near-Term Limits

The Trump administration plans talks with U.S. oil executives about rebuilding Venezuela’s oil industry, potentially with government support. However, analysts caution that restoring production would take years and billions of dollars due to damaged infrastructure, legal risks, and political uncertainty. While investor sentiment improved following the removal of President Nicolás Maduro, sanctions and embargoes continue to limit any immediate production boost.

Venezuela Crude Deal Pressures Prices

The U.S. and Venezuela agreed to export up to $2 billion (30–50 million barrels) of Venezuelan crude to the U.S., diverting supply from China. The announcement pushed U.S. crude prices down over 1.5% and softened heavy crude prices in the Gulf Coast. Increased Venezuelan flows would benefit U.S. refiners capable of processing heavy crude and could help lower fuel costs, while weighing on competing heavy crude suppliers such as Canada.

OPEC+ Holds Output Steady

OPEC+ kept oil production unchanged, reaffirming a pause in output hikes through March despite growing geopolitical tensions. Oil prices are down more than 18% in 2025, driven by oversupply concerns rather than shortages. The group continues to prioritize market stability, even as crises persist in Russia, Iran, and Venezuela. The next OPEC+ meeting is scheduled for February 1.

Markets Take Geopolitical Shock in Stride

Global markets reacted calmly to Venezuela’s political upheaval, with stocks edging higher and oil prices only slightly up. Investors see Venezuela as a small contributor to global supply and expect any production recovery to be slow. However, some strategists warn that markets may be underestimating broader geopolitical risks in Latin America, which could eventually weigh on the U.S. dollar and increase volatility.

Russia-Ukraine War Escalates

Russia intensified attacks on Ukraine’s energy infrastructure, including missile strikes on Kharkiv and a U.S.-owned agricultural facility in Dnipro. Ukraine responded with drone attacks on Russian oil and military facilities. The escalation adds to geopolitical uncertainty but has not yet caused major disruptions in global energy markets.

Bottom Line

Energy equities are reacting positively to potential Venezuelan supply and investment opportunities, while oil prices remain under pressure due to oversupply and cautious demand outlooks. Geopolitics are driving sentiment more than fundamentals, with markets calm for now—but risks are building beneath the surface.

If you have any questions or would like current pricing, please contact your Energy Account Manager.

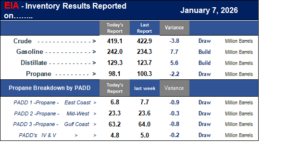

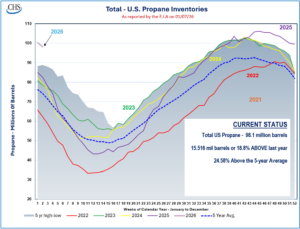

The market expected a 1.76 million barrel draw, but the EIA reported a larger 2.2 million barrel draw, bringing total inventories to 98.1 million barrels.

Exports increased week over week by 184,000 bpd, reaching 1.876 million bpd.

Despite the weekly draw, inventories remain 15.5 million barrels higher than last year.

Regional Inventory Changes

- Gulf Coast (PADD 3):−800,000 bbl

- Midwest (PADD 2): −300,000 bbl

- East Coast (PADD 1):−900,000 bbl

- PADDs 4 & 5: −200,000 bbl

Year-over-Year View

Total propane inventories are up 18.8% compared to last year, indicating ample supply despite recent draws.

If you have any questions or would like current pricing, please contact your Energy Account Manager.

Through our portal, you can check billing, make payments, request a quote, check previous years product usage, see invoices and statements, and much more. We also offer digital contracting through the portal where you can sign and pay your energy contracts through our mobile app or desktop site. Click here to log in!