A fragile ceasefire has taken hold between Iran and Israel after 12 days of intense conflict, brokered by U.S. President Donald Trump. The U.S. joined the war by striking Iranian nuclear facilities with bunker-buster bombs, though a preliminary intelligence assessment suggests the attacks only temporarily set back Iran’s nuclear program by one to two months. Trump claimed the strikes “obliterated” Iran’s capabilities, but the Defense Intelligence Agency reported otherwise, noting key infrastructure remained intact. Both Iran and Israel declared victory and lifted civilian restrictions, reopening airspace, and airports. Despite agreeing to the truce, each side accused the other of violating it shortly after it began, prompting Trump to harshly rebuke both nations, especially Israel, for continued aggression. Iranian President Pezeshkian expressed readiness to resolve tensions with the U.S., while Israeli leaders vowed to remain vigilant against future threats. The war left over 600 Iranians and 28 Israelis dead, marking the first significant breach of Israeli air defenses by Iran. Oil prices dropped and global markets rallied, reflecting relief that the conflict had not escalated further or disrupted energy supplies.

President Donald Trump stated that China can continue purchasing Iranian oil following a ceasefire between Israel and Iran, though the White House clarified this does not signal a loosening of U.S. sanctions. His comments contributed to a nearly 6% drop in oil prices, as markets interpreted them as a potential shift in enforcement. Trump emphasized Iran’s restraint in not closing the Strait of Hormuz, which is critical for Chinese oil imports, and urged China to also buy more U.S. oil. Despite previous sanctions targeting Chinese refiners for importing Iranian crude, experts say Trump’s stance reflects weakened enforcement rather than formal policy change. Analysts believe China’s near term oil trade with Iran, or the U.S. will remain largely unchanged due to tariffs and economic interests. China’s foreign ministry responded that it would act based on its own energy needs, while U.S. officials hinted at complex interagency steps if Trump moves to suspend sanctions.

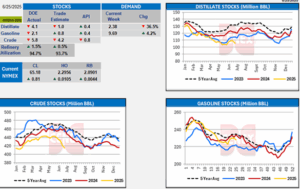

This week DOE’s report is below for your viewing.

Please call your Energy Account Manager with any needs you may have.

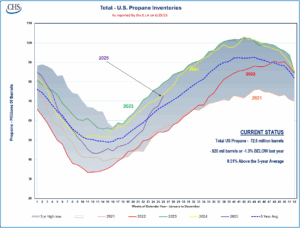

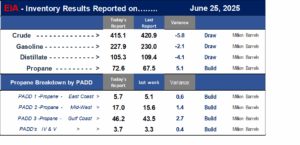

Propane

Propane/propylene inventories increased by 5.1 million barrels from last week and are 9% above the five-year average for this time of year. This is another good build for propane. Three of the last four weeks we had builds larger than expected. With these builds you can see on the inventory graph below that we are now close to the same level we were in 2024 at this time. As always exports could hinder our future builds. This week exports were down slightly. Still exporting 1,822 million barrels this week. We will have to continue to monitor the builds going forward and how high we can push inventories as we work the rest of the way through the summer.

This week DOE’s report is below for your viewing.

Please call your Energy Account Manager with any needs you may have.

NuWay-K&H Cooperative Customer Portal

Through our portal, you can check billing, make payments, request a quote, check previous years product usage, see invoices and statements, and much more. We also offer digital contracting through the portal where you can sign and pay your energy contracts through our mobile app or desktop site. Click here to log in!