Global Supply Shock: Russia

A Ukrainian strike on Russia’s port of Novorossiysk has temporarily halted roughly 2.2 million bpd of oil exports—about 2% of global supply. The disruption is tightening global balances and adding upward pressure and volatility to WTI.

Russia is trying to offset the loss with spare refining capacity, but export delays remain large. Nearly one-third of Russian seaborne volumes are currently stuck in tankers, adding further strain.

Overall, geopolitical risks continue to highlight how vulnerable global oil markets—and WTI pricing—are to regional conflict.

North America: Canada Boosts Exports

Enbridge approved a $1.4B expansion to its Mainline and Flanagan South pipelines, increasing the flow of Canadian heavy crude to U.S. refiners.

This added capacity strengthens regional supply security and may help ease WTI upward pressure from global disruptions.

The expansion also supports a tighter WTI–WCS differential, benefiting U.S. refiners.

China: Strong Refining Activity

China’s crude throughput rose 6.4% YoY in October, signaling stronger demand and a supportive backdrop for higher WTI prices.

However, refined product exports rose 14% YoY, helping offset some global tightness.

China is expected to cut Saudi term volumes in December, potentially reshuffling Asian supply flows.

Overall, Chinese demand momentum remains a bullish factor for global prices.

Europe: Diesel Sanctions Complicated

The EU is considering tighter restrictions on diesel refined from Russian crude—but enforcement is difficult due to complex trade routes.

A strict ban could raise freight costs, disrupt flows, and worsen diesel shortages as European refining capacity shrinks.

Any aggressive move would shift imports toward the U.S. and Asia, tightening global balances and impacting WTI-linked products.

Russia Sanctions: U.S. Measures Bite

U.S. Treasury actions against Rosneft and Lukoil are cutting Russian revenues and could reduce global supply over time—another bullish driver for WTI.

However, strong U.S. production and slowing global demand growth cap longer-term upside.

Saudi Arabia: Exports Rise

Saudi crude exports hit a 7-month high in September, adding supply to a market already wrestling with mixed demand signals.

These additional barrels contribute to a near-term bearish tone for WTI, especially during seasonal U.S. refinery maintenance.

Overall Market Outlook

The oil market remains a tug-of-war between:

Bullish forces:

- Russian export disruptions

- Growing Chinese demand

- Tighter diesel markets

- Ongoing geopolitical risk

Bearish forces:

- Rising Saudi supply

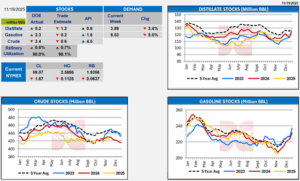

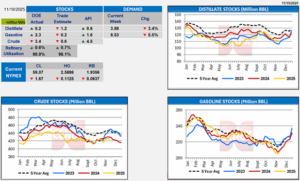

- U.S. inventory uncertainty

- Strong U.S. production

- Mixed global demand indicators

Expect continued WTI volatility as geopolitical tensions and supply shifts collide with fluctuating inventory data.

If you have any questions or would like current pricing, please contact your Energy Account Manager.

Propane

Winter Weather Buzz

USA Today recently featured MIT research scientist Judah Cohen, highlighting early winter weather forecast models and renewed attention on the polar vortex. While it’s too early to draw firm conclusions, the discussion is adding some seasonal interest to energy markets.

Major LPG Deal Supports U.S. Exports

In a significant development for U.S. propane and LPG markets, India has signed its first long-term contract to purchase U.S. LPG starting in 2026.

- India will receive 2.2 million tonnes of LPG, including 2 million metric tons of propane.

- This volume equals roughly 615.7 million gallons of propane.

- For context, that’s more propane than the entire state of Minnesota consumes in a year—a substantial boost to long-term export demand.

Market Takeaway

This new export commitment and growing weather-driven interest provide a supportive backdrop for U.S. propane markets as we look ahead to future supply-demand dynamics.

If you have any questions or would like current pricing, please contact your Energy Account Manager.

NuWay-K&H Cooperative Customer Portal

Through our portal, you can check billing, make payments, request a quote, check previous years product usage, see invoices and statements, and much more. We also offer digital contracting through the portal where you can sign and pay your energy contracts through our mobile app or desktop site. Click here to log in!