Fuel prices have been in a see-saw pattern recently. Mid-March had several days of gains, the last few days have calmed a bit, or perhaps that is just buyers jumping in to take advantage of price points. This morning crude, distillate, and gas were all up slightly. At the time of this writing crude and distillate are almost even, and gas is up $0.019 on the day.

The factors currently effecting prices are mostly global. To the upside, Saudi Arabia announced crude cuts to extend into June, as well as Iraq reducing crude exports by 3.3 million barrels per day in the coming months to compensate for exceeding the OPEC quota earlier. The next OPEC+ meeting doesn’t occur until April 3rd, but traders anticipate that Saudi Arabia and its allies will continue to extend their cuts this year. Other events to the upside have been recent drone strikes by Ukraine targeting Russia’s oil infrastructure. In retaliation it is being reported that Russia launched over 150 missiles and drone attacks on Ukrainian infrastructure overnight. Any further escalation could add pressure to market dynamics.

To the downside, there are reports that the U.S. drafted a U.N. resolution calling for a ceasefire and hostage exchange in Gaza. A potential ceasefire would help soften the Red Sea conflict which may ease increases noticed due to supply disruptions as tanker ships have been taking longer routes to avoid this volatile shipping lane. Another chance for the bears to resurface would be news here at home. The Fed on Wednesday announced that they are going to leave the 23-year high interest rates between 5.25% and 5.5%. The rates will stay here for now to try and counter some sharp price increases. This helps keep the market from forging ahead. Keep in mind though, any kind of drop in interest rates could signal positive movement in the economy and may lead to an increase in fuel demand, and therefore pushing prices higher.

We are contracting refined fuel for spring, summer, and fall, if you would like to get price quotes, please reach out to your Energy Account Manager.

Propane

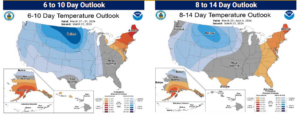

That old adage of March continues. It came in like a lamb and is going out like a lion. For many in the NuWay-K&H trade territory, you probably woke up this morning to see a few inches of snow on the ground. The bad news, its cold, the good news, some much needed moisture. LP prices have seen small spikes recently. Strength of propane this week has been related to fresh export demand, with reports of an increased number of cargoes from the Gulf as margins to export to Asia have become better. Also, the colder temps we are seeing through a good portion of the U.S. has put an increase on demand (see chart below). These patterns will extend out into April. Hopefully this will be short lived, spring planting can begin, and we can turn the furnace off!

We are contracting for the next season’s drying and heating timeframes, if you are interested, please contact your Energy Account Manager.

NuWay-K&H Cooperative Customer Portal

Through our portal, you can check billing, make payments, request a quote, check previous years product usage, see invoices and statements, and much more. We also offer digital contracting through the portal where you can sign and pay your energy contracts through our mobile app or desktop site. Click here to log in!