Energy markets are seeing gains across the board this morning. There are multiple contributing factors this week. Here are a couple of headlines we are watching. U.S. debt ceiling, Fed rate hikes scheduled for June, China demand, wildfires in Canada. These issues were enough to push markets higher even though we had a good Department of Energy Report which you can find below. Let’s explore these issues and the effects they are having on the market place.

U.S. debt ceiling. There are some fears of a stalemate over the US debt ceiling. President Joe Biden and House Speaker Kevin McCarthy have both went on the record stating they both desire to reach an agreement. Democratic sources claim that “steady progress” is being made. If Congress does not decide to raise the debt ceiling, the US government could default on some debts as soon as June 1st. Economists fear the US could enter into a recession.

Rising interest rates are also adding to the fears of a recession. Fed fund futures are suggesting that there is now a 40% chance of a rate increase in June vs the 20% chance reported earlier this week. A couple US Federal Reserve members stated that US inflation does not appear to be slowing quickly enough. So at this point the Fed has no information leading them to a point to suspend its tightening drive.

China’s refinery utilization rates rose on anticipation of increased demand. China’s refineries processed 14.87 million barrels per day of oil in April. This is the second highest on record. March was 14.9 million barrels per day processed. Chinese Premier Li Qiang urged measures to improve the real economy this week. He also stated developing local demand, and stabilize external demand to foster economic recovery. Revenues increased for China year over year in the first four months of 2023, according to official figures.

Canada wildfires are now up to 92 confirmed fires as of this morning. Chevron, Paramount Resources, Crescent Point Energy, and Kiwetinohk Energy all announced production shut-ins and evacuated staff because of these fires. According to Christie Tucker, a spokeswoman for Alberta Wildfire, conditions are expected to worsen over the weekend as the weather becomes hotter and dryer. Supply is already tight and these production shut-ins are helping support pricing.

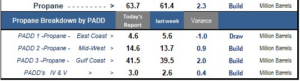

Propane

Barring any major movement today, propane hubs are on track for a slight loss on the week. The bearish Department Of Energy Report, shown below, was able to hold the market even this week. With the fundamentals being bearish on propane, any strong run upward would most likely be related to crude movement. Propane is currently trading at 38% of crude. This is a little lower than weeks past.

Another factor to propane pricing is exporting. As of 5-12-23 the US is exporting 65% of production. Currently this is not having a major effect on the market as we are not in our heavy usage time. We will be keeping an eye on this as we move through the summer and into fall as we could see higher demand if there is a need for corn drying.

NuWay-K&H Customer Portal

Through our portal, you can check billing, make payments, request a quote, check previous years product usage, see invoices and statements, and much more. We also offer digital contracting through the portal where you can sign and pay your energy contracts through our mobile app or desktop site. Click here to log in!